PARIS – November 2, 2021 – Sequans Communications S.A. (NYSE: SQNS), a leading developer and provider of 5G/4G chips and modules, today announced financial results for the third quarter ended September 30, 2021.

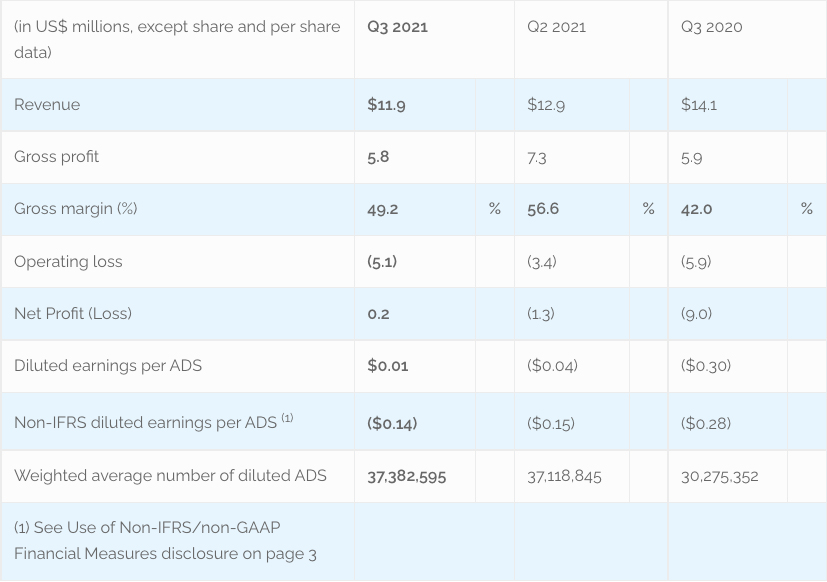

Third Quarter 2021 Summary Results Table:

“The increasing momentum we are experiencing in our Massive IoT and CBRS Broadband categories is a testament to Sequans’ strategy to deliver industry-leading 5G/4G chips and modules optimized for a multitude of IoT applications,” said Georges Karam, CEO of Sequans. “Year-to-date, our revenue grew by 6%, despite the termination of Jetpack portable router sales in 2021. Third quarter revenue grew by 106% year-over-year, mainly driven by Massive IoT increasing 118% and CBRS Broadband rising 135% when adjusted to exclude last year’s Jetpack contribution(1). This strong performance was limited by supply chain constraints, limiting our ability to meet the robust demand for our chips and modules. Our MCU and channel partners, with their powerful brands and extensive global reach, are also contributing to our growth, and we anticipate growth from these channels to accelerate next year.

“In the third quarter, the portion of our pipeline secured by design wins increased to almost $300 million, which represents nearly 50% of the pipeline,” continued Mr. Karam. “Promising opportunities primarily in Massive IoT, but also in our Broadband IoT category, are driving our pipeline growth. This quarter we secured new design-in awards in metering, medical, asset tracking, and industrial applications and achieved excellent progress on existing design wins advancing to mass production in 2022.

Mr. Karam concluded, “Sequans believes the investment in 5G is strategic for the long term given the unique opportunity it presents for our game-changing IoT technology. However, we recognize that rather than receiving credit for the long-term value being created by our 5G strategy, the cash burden related to this investment is negatively impacting the Company’s valuation. The company is actively exploring options to finance Sequans’ 5G investment to minimize its cash burden, with the goal of upholding our leadership in the Massive IoT and maximizing value for shareholders over the long run”.

_________________________

(1) Revenues from the Verizon Jetpack were $8.4 million in the third quarter of 2020. There were no revenues from the Verizon Jetpack in the third quarter of 2021

Q4 2021 Outlook

The following statement is based on management’s current assumptions and expectations and assumes no increase in the severity or duration of the COVID-19 pandemic and supply chain constraints. This statement is forward-looking and actual results may differ materially.

Taking into consideration current customer demand and the ongoing impact of supply chain constraints on the Company’s ability to ship orders, management is targeting 15% sequential revenue growth for the quarter ending December 31, 2021.

Third Quarter 2021 Financial and Operational Results Summary

Revenue for the third quarter was $11.9 million, a decrease of 7.5% compared to the second quarter of 2021 and a decrease of 15.8% compared to the third quarter of 2020. The decrease from the second quarter was primarily due to expected lower services revenue based on the advancement of the various projects, partially offset by increases in product revenue for both Massive IoT and Broadband IoT.

Gross profit for the third quarter of 2021 was $5.8 million, a $1.4 million decrease from the second quarter and a modest decrease from the prior year third quarter. Gross margin for the third quarter of 2021 was 49.2% compared to 56.6% in the second quarter of 2021 and 42.0% in the third quarter of 2020. The sequential decrease in gross margin was primarily due to the revenue mix with a shift towards more product revenue in the quarter.

Operating loss was $5.1 million compared to $3.4 million in the second quarter of 2021 and $5.9 million in the third quarter of 2020. The sequential increase in operating loss was primarily due to a lower gross margin on lower revenues and lower operating expenses in the second quarter of 2021 due to a one-time net reduction in R&D expense of approximately $1.2 million as a result of an R&D grant recognized in the second quarter.

Net profit was $0.2 million, or $0.01 per diluted ADS, compared to net losses of $1.3 million, or ($0.04) per ADS, in the second quarter of 2021 and $9.0 million, or ($0.30) per ADS, in the third quarter of 2020. Net profit in the third quarter of 2021 includes a $7.7 million benefit from the change in fair value of convertible debt derivative and $409,000 foreign exchange gain primarily related to the revaluation of euro liabilities during the quarter.

Non-IFRS Net loss and diluted loss per ADS: Excluding the non-cash stock-based compensation, the non-cash impact of the fair-value and effective interest adjustments related to the convertible debt with embedded derivatives and other financings, the non-cash impact of debt reimbursement, and deferred tax benefit or expense related to the convertible debt and other financings, non-IFRS net loss was $5.3 million, or ($0.14) per ADS, compared to $5.6 million, or ($0.15) per ADS in the second quarter of 2021, and $8.4 million, or ($0.28) per ADS, in the third quarter of 2020.

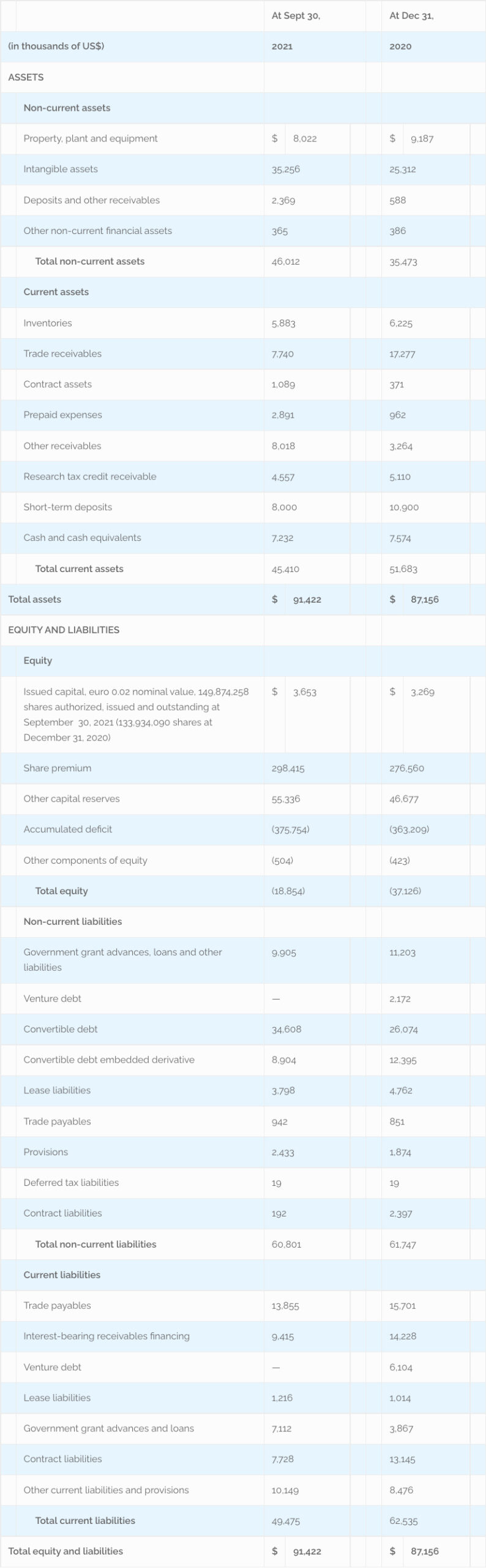

Cash: Cash, cash equivalents, and short-term deposits at September 30, 2021 totaled $15.2 million compared to $18.5 million at December 31, 2020.

Conference Call and Webcast

Sequans plans to conduct a teleconference and live webcast to discuss the financial results for the third quarter of 2021 today, November 2, 2021 at 8:00 a.m. ET /13:00 CET. To participate in the live call, analysts and investors should dial 877-407-0792 or +1 201-689-8263 if outside the U.S. When prompted, provide the event title or access code: 13723445. A live and archived webcast of the call will be available from the Investors section of the Sequans website at www.sequans.com/investors/. An audio replay of the conference call will be available until November 16, 2021 by dialing toll free 844-512-2921 or +1 412-317-6671 from outside the U.S., using the following access code:13723445.

Forward Looking Statements

This press release contains projections and other forward-looking statements regarding future events or our future financial performance and potential financing sources. All statements other than present and historical facts and conditions contained in this release, including any statements regarding future results of operations and financial positions, business strategy and plans, including financing alternatives for our 5G business, expectations for Massive IoT sales, the impact of the Covid-19 on our supply chain and on customer demand, the impact of component shortages and manufacturing capacity, our ability to convert our pipeline to revenue and our objectives for future operations, are forward-looking statements (within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended). These statements are only predictions and reflect our current beliefs and expectations with respect to future events and are based on assumptions and subject to risk and uncertainties and subject to change at any time. We undertake no obligation to update the information made in this release in the event facts or circumstances subsequently change after the date of this press release. We operate in a very competitive and rapidly changing environment. New risks emerge from time to time. Given these risks and uncertainties, you should not rely on or place undue reliance on these forward-looking statements. Actual events or results may differ materially from those contained in the projections or forward-looking statements. In addition to the risk factors contained in our Form 20-F for the fiscal year ended December 31, 2020, some of the factors that could cause actual results to differ materially from the forward-looking statements contained herein include, without limitation: (i) the contraction or lack of growth of markets in which we compete and in which our products are sold, (ii) unexpected increases in our expenses, including manufacturing expenses, (iii) our inability to adjust spending quickly enough to offset any unexpected revenue shortfall, (iv) delays or cancellations in spending by our customers, (v) unexpected average selling price reductions, (vi) the significant fluctuation to which our quarterly revenue and operating results are subject due to cyclicality in the wireless communications industry and transitions to new process technologies, (vii) our inability to anticipate the future market demands and future needs of our customers, (viii) our inability to achieve new design wins or for design wins to result in shipments of our products at levels and in the timeframes we currently expect, (ix) our inability to enter into and execute on strategic alliances, (x) our ability to meet performance milestones under strategic license agreements, (xi) the impact of natural disasters on our sourcing operations and supply chain, (xii) the impact of Covid-19 on the ability to operate our business and research, production of our products or demand for our products by customers whose supply chain is impacted or whose operations have been impacted by government shelter-in-place or similar orders, (xiii) our ability to raise debt and equity financing, and (xv) other factors detailed in documents we file from time to time with the Securities and Exchange Commission.

Use of Non-IFRS/non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements prepared in accordance with IFRS, we disclose certain non-IFRS, or non-GAAP, financial measures. These measures exclude the non-cash stock-based compensation and the non-cash impacts of convertible debt amendments, conversions and repayments, effective interest adjustments related to the convertible debt with embedded derivatives and other financings; and deferred tax benefit or expense related to the convertible debt and other financings. We believe that these measures can be useful to facilitate comparisons among different companies. These non-GAAP measures have limitations in that the non-GAAP measures we use may not be directly comparable to those reported by other companies. We seek to compensate for this limitation by providing a reconciliation of the non-GAAP financial measures to the most directly comparable IFRS measures in the table attached to this press release.

About Sequans Communications

Sequans Communications S.A. (NYSE: SQNS) is a leading developer and provider of 5G and 4G chips and modules for IoT devices. For 5G/4G massive IoT applications, Sequans provides a comprehensive product portfolio based on its flagship Monarch LTE-M/NB-IoT and Calliope Cat 1 chip platforms, featuring industry-leading low power consumption, a large set of integrated functionalities, and global deployment capability. For 5G/4G broadband and critical IoT applications, Sequans offers a product portfolio based on its Cassiopeia 4G Cat 4/Cat 6 and high-end Taurus 5G chip platforms, optimized for low-cost residential, enterprise, and industrial applications. Founded in 2003, Sequans is based in Paris, France with additional offices in the United States, United Kingdom, Israel, Hong Kong, Singapore, Finland, Taiwan, South Korea, and China.

Visit Sequans online at www.sequans.com; www.facebook.com/sequans; www.twitter.com/sequans

Media Relations: Kimberly Tassin, +1.425.736.0569, Kimberly@sequans.com

Investor Relations: Kimberly Rogers, +1 385.831-7337, krogers@sequans.com

Condensed financial tables follow

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

(1) Including $1.4 million related to the forgiveness of a debt in April 2021

SEQUANS COMMUNICATIONS S.A.

UNAUDITED RECONCILIATION OF NON-IFRS FINANCIAL RESULTS

SEQUANS COMMUNICATIONS S.A.

UNAUDITED RECONCILIATION OF NON-IFRS FINANCIAL RESULTS